Executive Summary North America Health Insurance Market :

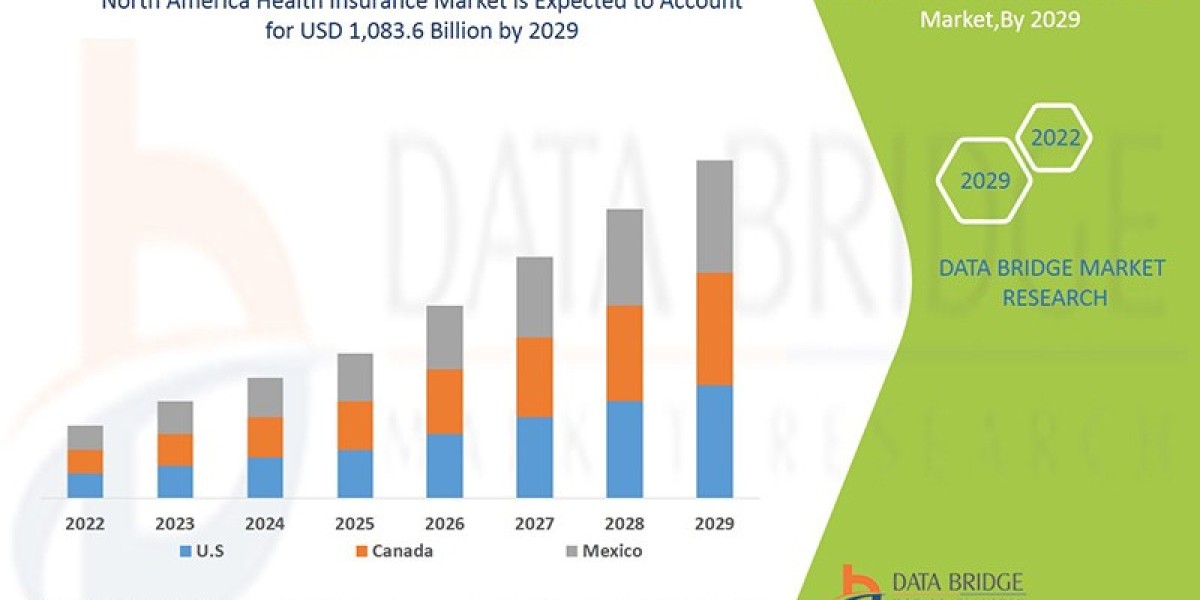

Data Bridge Market Research analyses that the health insurance market is expected to reach the value of USD 1,083.6 billion by the year 2029, at a CAGR of 5.4% during the forecast period.

In this North America Health Insurance Market report, industry trends are formulated on macro level which assists comprehend market place and possible future issues. The report gives details about the emerging trends along with key drivers, challenges and opportunities in the industry. The report explains the moves of top market players and brands that range from developments, products launches, acquisitions, mergers, joint ventures, trending innovation and business policies. Geographical areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa are also considered for the market analysis. North America Health Insurance Market report can be utilized efficiently by both established and new players in the industry for absolute understanding of the market.

This North America Health Insurance Market research report describes the major moves of the top players and brands such as developments, product launches, acquisitions, mergers, joint ventures and competitive research in the market. This is a professional and in-depth study on the current state which focuses on the major drivers and restraints of the key market players. The North America Health Insurance Market report provides a great understanding of the current market situation with the historic and upcoming market size based on technological growth, value and volume, projecting cost-effective and leading fundamentals in the market. Analysis and discussion of important industry trends, market size, and market share estimates are revealed in the North America Health Insurance Market report.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive North America Health Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/north-america-health-insurance-market

North America Health Insurance Market Overview

**Segments**

- **By Provider**: The health insurance market in North America can be segmented based on providers, including private health insurance companies and government-sponsored programs such as Medicaid and Medicare. Private health insurance companies offer a variety of plans tailored to individuals, families, and businesses, providing coverage for medical expenses. On the other hand, government-sponsored programs like Medicaid cater to low-income individuals and families, while Medicare serves the elderly population.

- **By Type**: The market can also be segmented based on the type of health insurance plans offered. This includes fee-for-service plans, health maintenance organizations (HMOs), preferred provider organizations (PPOs), point of service (POS) plans, and high-deductible health plans (HDHPs). Each type of plan has different features, costs, and coverage levels, catering to the diverse needs of consumers in the North American health insurance market.

- **By Demographics**: Another important segmentation factor is demographics, which involves dividing the market based on characteristics such as age, gender, income level, and geographic location. Different demographic groups have varying healthcare needs and preferences, influencing their choice of health insurance plans. For example, older individuals may opt for plans with comprehensive coverage and lower out-of-pocket costs, while younger populations might prioritize affordability and flexibility.

**Market Players**

- **UnitedHealth Group**: As one of the largest health insurance providers in North America, UnitedHealth Group offers a wide range of health insurance products and services to individuals, employers, and government entities. The company's extensive network, innovative healthcare solutions, and focus on improving patient outcomes have solidified its position in the market.

- **Anthem, Inc.**: Anthem, Inc. is another key player in the North American health insurance market, known for its diverse portfolio of health plans and commitment to enhancing access to quality healthcare. The company's strategic partnerships, digital health initiatives, and emphasis on preventive care have helped Anthem maintain a competitive edge in the industry.

- **CVS Health**: CVS Health, a prominent player in the health insurance market, operates a health insurance segment through its subsidiary, Aetna. The company's integrated healthcare model, which combines pharmacy services, care delivery, and insurance coverage, offers a unique value proposition to consumers in North America.

- **Humana Inc.**: Humana Inc. is a leading health insurance provider that specializes in Medicare Advantage plans, prescription drug coverage, and wellness programs. The company's focus on population health management, data analytics, and customer-centered innovations has positioned Humana as a trusted partner in the North American healthcare ecosystem.

The North America Health Insurance Market is competitive and dynamic, with key players continually evolving their strategies to meet changing consumer needs, regulatory requirements, and technological advancements. As healthcare delivery models shift towards value-based care and digital transformation, market players must adapt their offerings and operations to stay relevant and competitive in the rapidly evolving landscape.

The North America health insurance market is characterized by intense competition and constant evolution, driven by factors such as changing consumer expectations, regulatory dynamics, and technological advancements. A key trend shaping the market landscape is the increasing focus on value-based care, which emphasizes delivering quality healthcare outcomes at an efficient cost. Market players are aligning their strategies to support value-based care initiatives, such as care coordination, preventive services, and population health management, to enhance patient outcomes and satisfaction.

Moreover, digital transformation is poised to have a profound impact on the North American health insurance market. As technology continues to disrupt the healthcare industry, market players are leveraging digital solutions to streamline operations, enhance customer experience, and drive innovation. From telemedicine services to digital health platforms, insurers are investing in technology to meet the evolving needs of tech-savvy consumers and improve accessibility to healthcare services.

An emerging trend in the market is the growing importance of data analytics and artificial intelligence in decision-making processes. By harnessing the power of data, health insurance providers can gain valuable insights into consumer behavior, healthcare trends, and cost drivers, enabling them to make informed business decisions and enhance operational efficiency. AI-driven solutions are also being used to automate tasks, personalize customer interactions, and detect fraud, thereby improving outcomes and reducing costs for insurers.

Furthermore, the regulatory environment plays a significant role in shaping the North American health insurance market. Insurers must navigate a complex landscape of regulations, compliance requirements, and policy changes to ensure transparency, fairness, and consumer protection. The evolving regulatory framework, including reforms to healthcare legislation and insurance mandates, poses both challenges and opportunities for market players as they strive to adapt and comply with changing rules and standards.

In conclusion, the North America health insurance market is a dynamic and competitive space, driven by trends such as value-based care, digital transformation, data analytics, and regulatory dynamics. Market players must stay agile, innovative, and customer-centric to thrive in this evolving landscape. By embracing technology, leveraging data insights, and aligning with regulatory requirements, insurers can position themselves for success and deliver value to consumers in the rapidly changing healthcare ecosystem.The North America health insurance market is witnessing significant transformations driven by various factors influencing the industry landscape. One crucial aspect impacting the market is the evolving consumer expectations, where individuals are increasingly seeking personalized and convenient healthcare solutions. This shift is pushing health insurance providers to innovate their offerings, enhance customer experience, and tailor services to meet the unique needs of diverse consumer segments. As a result, market players are introducing digital solutions, telemedicine services, and other technological advancements to cater to the growing demand for accessible and efficient healthcare services.

Moreover, the emphasis on value-based care is reshaping how health insurance is delivered and managed in the region. Value-based care models prioritize improving patient outcomes, enhancing quality of care, and reducing healthcare costs through a collaborative approach between providers, insurers, and patients. To align with this trend, market players are focusing on care coordination, preventive services, and population health management initiatives to drive better healthcare outcomes and ensure patient satisfaction. By proactively engaging in value-based care strategies, insurers can position themselves as trusted partners in promoting holistic and sustainable healthcare solutions.

Another notable trend in the North America health insurance market is the increasing reliance on data analytics and artificial intelligence (AI) tools to optimize decision-making processes and enhance operational efficiency. Utilizing data-driven insights, insurers can gain a deeper understanding of consumer behaviors, healthcare trends, and cost drivers, enabling them to make informed business decisions and improve overall performance. AI technologies are being leveraged to automate tasks, personalize customer interactions, and detect fraudulent activities, ultimately improving outcomes and reducing operational costs for market players.

Furthermore, the regulatory landscape plays a critical role in shaping the dynamics of the North America health insurance market. Insurers must navigate a complex framework of regulations, compliance requirements, and policy changes to ensure transparency, fairness, and consumer protection. As regulatory reforms continue to shape the healthcare ecosystem, market players need to remain agile and adaptive to meet evolving standards and requirements. By staying abreast of regulatory developments, insurers can demonstrate compliance, build trust with consumers, and navigate the regulatory challenges effectively to maintain a competitive edge in the market.

In conclusion, the North America health insurance market is undergoing a profound evolution driven by shifting consumer expectations, the adoption of value-based care models, advancements in digital technologies, and regulatory dynamics. Market players are embracing innovation, data analytics, and compliance strategies to meet the changing needs of consumers, enhance operational efficiency, and drive sustainable growth in a competitive market environment. By addressing these trends proactively and strategically, health insurance providers can position themselves for success and deliver enhanced value to stakeholders in the evolving healthcare landscape.

The North America Health Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/north-america-health-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global North America Health Insurance Market Industry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global North America Health Insurance Market

- The current market is quantitatively analyzed to highlight the North America Health Insurance Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

- The report provides a detailed global North America Health Insurance Market analysis based on competitive intensity and how the competition will take shape in coming years.

Browse More Reports:

Global CNG, RNG, and Hydrogen Tanks Market

Global Hepatosplenomegaly Market

Global Anal Fistula Treatment Market

Europe Nucleic Acid Isolation and Purification Market

Global Skin Graft Market

Middle East and Africa Digital Therapeutic (DTx) Market

Global Waterproof Speaker Market

Global Cottonseed Hulls Market

Middle East and Africa Menopausal Disorder Treatment Market

Middle East and Africa Medical Equipment Maintenance Market

Global Data Centre Transformation Market

Global Thermoform Trays Market

Global Riboflavin Market

Global Acaricides Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com